Cloud computing has become a significant factor in streamlining business operations. It provides services like compute, storage, databases, cybersecurity, analytics, AI-powered cloud products, and more over the Internet. It offers faster innovation, economies of scale, and flexible resources, so many companies are integrating it.

Over 90% of companies worldwide already use cloud services—including AWS, Google, and Microsoft. The number of cloud computing users will grow significantly in the coming years.

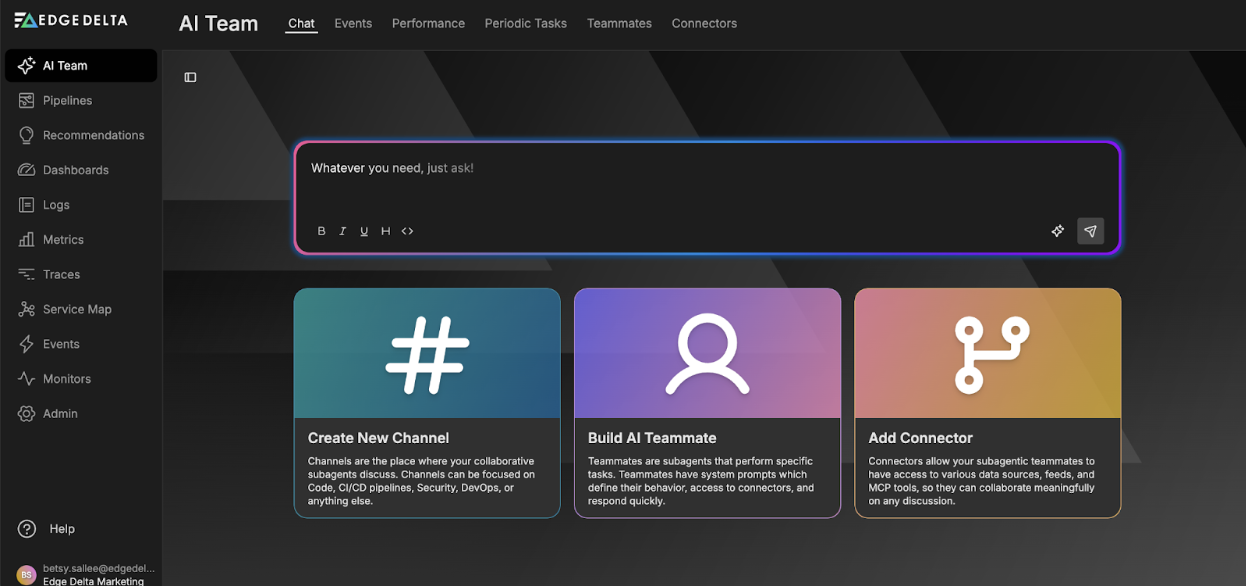

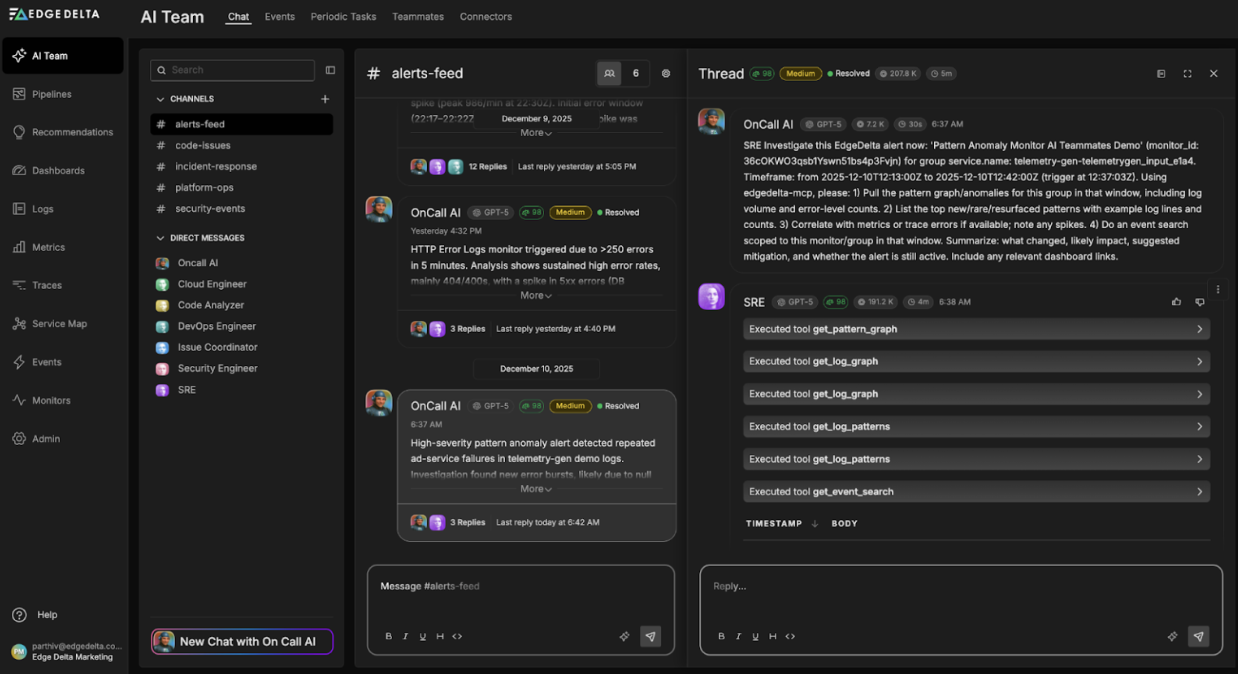

Automate workflows across SRE, DevOps, and Security

Edge Delta's AI Teammates is the only platform where telemetry data, observability, and AI form a self-improving iterative loop. It only takes a few minutes to get started.

Learn MoreExplore more about cloud computing by looking at its statistics. Discover how many companies use cloud computing, its market size, and more.

Editor’s Choice

- 94% of all companies worldwide use cloud computing in their operations.

- Forbes Global has generated an EBITDA value of over $3 trillion.

- Market drivers for public cloud computing have increased to 23.8%.

- AWS dominated the market with a 32% cloud market share.

- 85% of organizations are projected to embrace a cloud-first principle by 2025.

- 73% of the insurance sector uses hybrid architectures.

- Global Cloud Computing garnered $331 billion, projected to grow by 23%.

- 97% of IT leaders are planning to expand their cloud systems.

- Public cloud end-user spending is projected to increase by 20.7% worldwide.

By the Numbers: Company Use of Cloud Computing in 2024

A Cloud Security Alliance report revealed that 98% of organizations worldwide use cloud services. This includes SaaS applications and complete cloud-native networks.

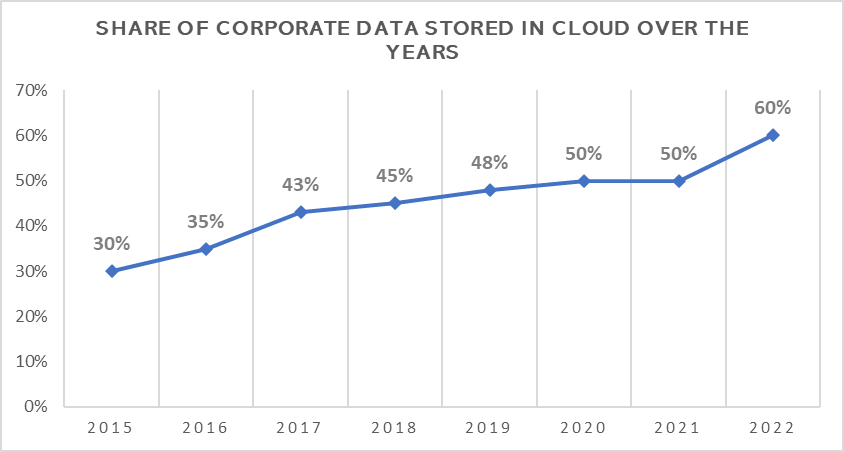

Recent data indicates a significant rise in cloud usage yearly. A 2022 study with 753 technical and business professionals worldwide reported that 63% of the respondents used the cloud ‘heavily.’ The use of cloud services was 59% in 2021 and 53% in 2020.

Read the following sections to understand the cloud computing market, its adoption rate, market players, and more.

Top Trends and Insights Shaping the Cloud Computing Market

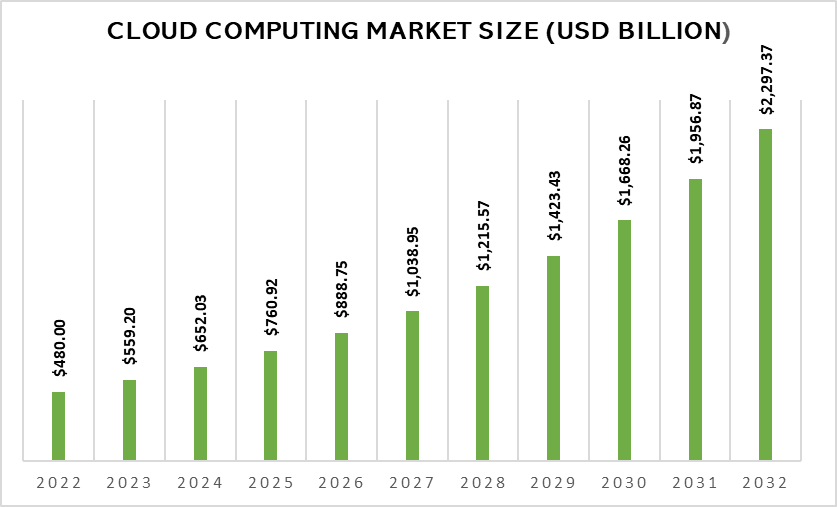

The global cloud computing market has significantly increased to $446.51 billion in 2022 and garnered $500 billion in 2023. It is expected to surpass $1 trillion by 2028 and $1.6 trillion by 2030. The latest report predicts the market will grow at a significant CAGR of 17.43% through 2032.

Discover more about the latest trends and statistics in the cloud computing market below.

1. 94% of companies worldwide are adopting cloud computing.

(Zippia)

The cloud has become an essential mainstay for many US companies. 94% of major companies worldwide utilize cloud computing in their operations.

In 2023, corporate data garnered 60% of data stored in the cloud. This data reveals how most businesses use the cloud for storage, and nearly half trust its security and reliability enough to store their more crucial data.

2. Cloud computing adoption will generate over $3 trillion by 2030.

(McKinsey & Company)

Cloud adoption among 2000 companies by Forbes Global will generate an EBITDA value of over $3 trillion by 2030. This prediction also applies value drivers to Fortune 500 companies. McKinsey & Company estimates the latter group will generate an EBITDA value of more than $1 trillion in the same period.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) Definition

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric that measures a company’s operating performance by excluding the effects of financing and accounting decisions. It provides a clearer view of profitability from core business activities.

3. In 2023, cloud computing market drivers for public cloud increased to 23.8%.

(MarketsandMarkets, Statista)

Companies are evolving to cater to customers’ needs. The demand for integrating cloud computing services is also increasing due to its scalability, reliability, and security. Cloud spending rose by 35% or $29 billion in 2020. In 2023, the market drivers for public cloud computing increased significantly to 23.8%.

Due to the COVID-19 pandemic, cloud spending increased by 9%. However, IT spending declined by 8%. Based on recent data, corporate cloud computing spending has doubled its rates as information officers and other tech leaders prefer cutting-edge features like AI that are more expensive than standard business apps.

Because of the present macroeconomic factors, the number of cloud users is increasing. These include:

- 42% using cloud-based services

- 33% plan to migrate from legacy software to cloud-based tools

- 32% migrated on-premises workloads to the cloud

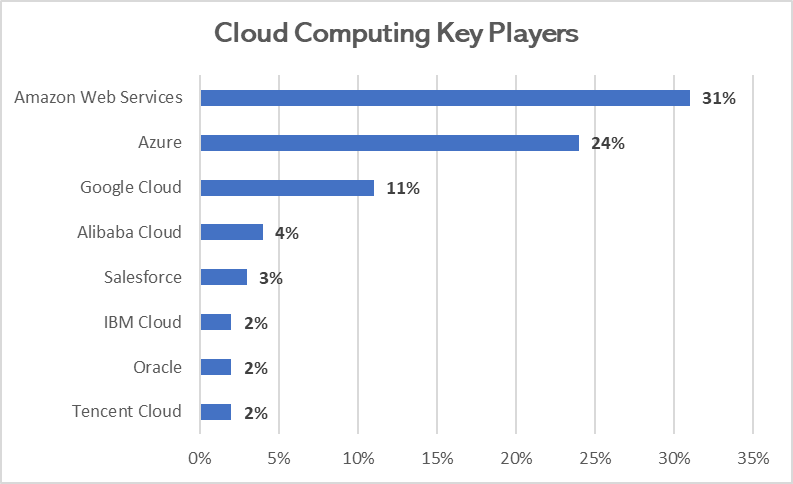

4. Amazon Web Services dominated the cloud computing key players with a 32% market share.

(PC Mag, Statista)

According to Synergy Research Group, four major players in cloud computing own 67% of the world cloud market. That is equivalent to $130 billion. Amazon Web Services (AWS) dominated the market with a 32% cloud market share, followed by Microsoft Azure with 20%.

The other two companies are Google Cloud and Alibaba Cloud, with 9% and 6% respectively. Following the four major players are IBM Cloud, Salesforce, Tencent Cloud, and Oracle Cloud—with a combined 9% share.

Unveiling Surprising Cloud Computing Adoption Statistics

Globally, businesses use public, private, and hybrid clouds. According to Gartner, more than 85% of organizations will embrace a cloud-first principle by 2025. They can only fully execute their digital strategies using cloud-native architectures and technologies.

Business Wire also said that the cloud computing market is projected to reach US$ 1,251.09 billion by 2028, attaining a CAGR of 19.1% over the forecast period. Factors like digital transformations in various industries and big data consumption can be attributed to this growth.

The statistics below show how many companies use cloud computing services to navigate and streamline their operations.

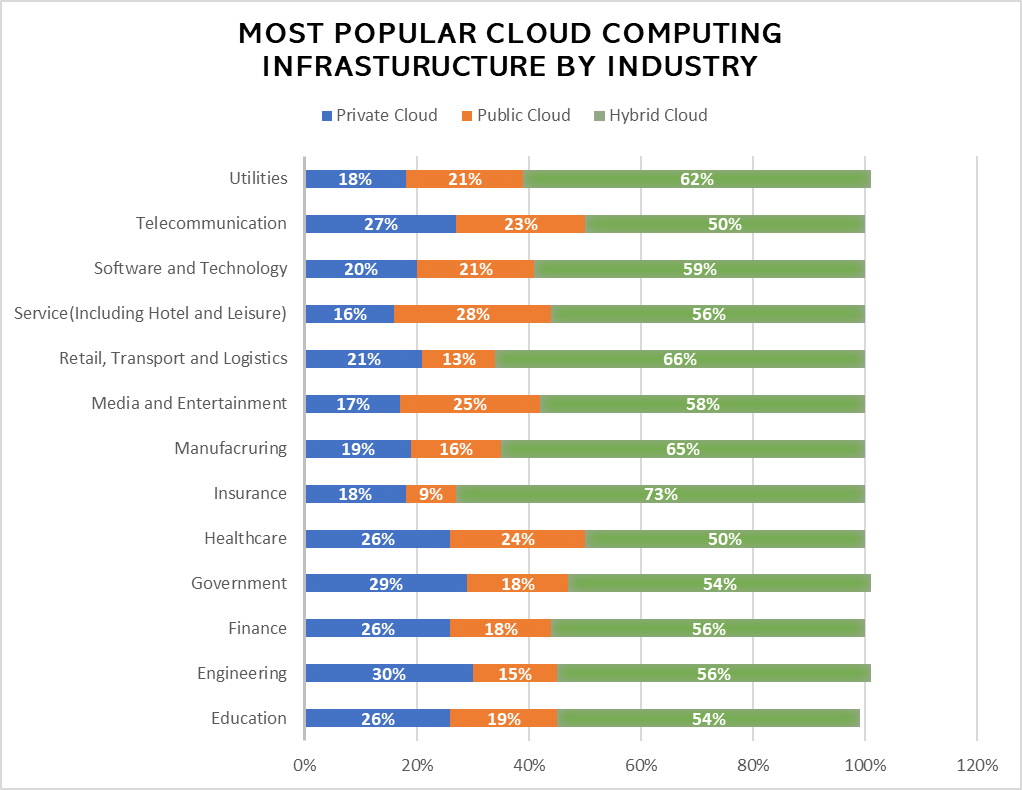

5. Hybrid cloud is the top choice for the insurance industry, with 73% adoption.

(Cloud Worldwide Service, Forbes)

Although public and private cloud first dominated the market, hybrid infrastructures remain popular across all industries.

Hybrid architectures are predominantly the first choice in the insurance sector at 73%, as only 18% rely on a private cloud, and 9% would rather stay with a public infrastructure. On the contrary, public cloud adoption attained the highest among organizations in the services industry, with 28% relying on public-only technologies.

6. 22% of companies use public cloud computing services.

(T4AI)

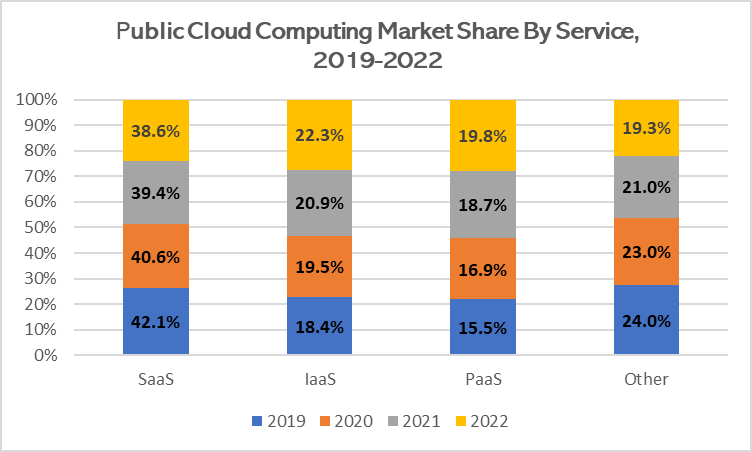

In 2018, the Global Cloud Computing industry garnered $331 billion, predicted to grow by 23%. The public cloud obtained the highest market share among other models, with 78%. It is followed by the private cloud with a 22% market size.

From 2019 to 2022, the leading service in the public cloud computing industry is SaaS, with a 38.6% market share in 2022. IaaS followed with 22.3%, then PaaS with 19.8%

7. 89% of companies use a multi-cloud approach.

(Exploding Topics, Flexera)

Across a wide range of businesses, 89% of companies use a multi-cloud approach. 80% use a hybrid approach, using either private or public cloud computing. 97% of IT leaders intend to expand their cloud systems further by using one or more clouds in their systems.

In 2022, 61% of businesses use one or two clouds—with 34% using one cloud and 27% using two. The number of organizations using three clouds was almost reduced to half, from 20% in 2019 to 11% in 2022. Meanwhile, companies using four cloud services have dipped from 7% to 3%.

The table below shows the number of clouds used by companies over the years:

| Year | 0 Clouds | 1 Cloud | 2 Clouds | 3 Clouds | 4 Clouds | 5+ Clouds | Clouds |

|---|---|---|---|---|---|---|---|

| 2019 | 9% | 30% | 32% | 20% | 7% | 2% | 20 |

| 2020 | 7% | 33% | 30% | 20% | 6% | 3% | 21 |

| 2021 | 4% | 35% | 30% | 22% | 6% | 2% | 22 |

| 2022 | 6% | 34% | 27% | 11% | 3% | 2% | 22 |

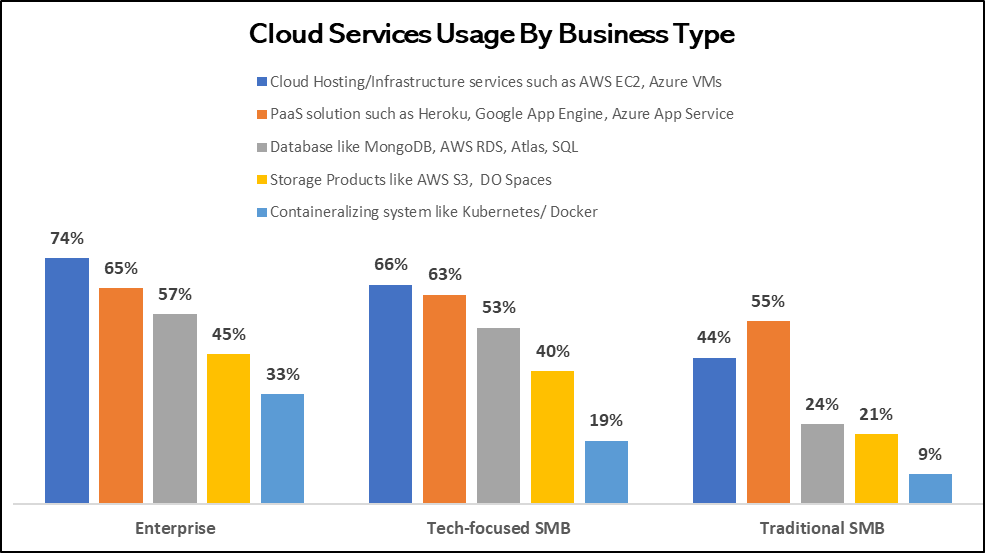

8. Traditional SMBs are less likely to use cloud computing services.

(Digital Ocean)

Small and medium-sized businesses (SMBs) comprise a considerable part of the economy and cloud computing adoption. A Digital Ocean survey of 2,400 IT decision-makers in 48 countries shows how prominent cloud computing is in three business types.

- Traditional SMBs: Companies with less than 500 employees and non-technology product offerings for end users.

- Tech-focused SMBs: Companies with less than 500 employees that supply technology-focused and hybrid products to customers

- Enterprises: Companies with over 500 employees

Traditional SMBs require intricate cloud computing setups and are less likely to use cloud hosting solutions, including databases and containerization systems. Nine percent of traditional SMBs employ containerization systems such as Kubernetes or Docker, compared to 19% of tech-focused SMBs and 33% of enterprises.

9. Public cloud end-user spending is projected to increase by 20.7% worldwide.

(Statista, Gartner)

Cloud computing solutions have become essential for its services, utilizing networks of distant servers across the Internet. Recent data shows that IT services were expected to generate revenues exceeding 670 billion US dollars in 2024 and will continue their rapid growth trajectory.

According to Gartner’s latest forecast, public cloud services end-user spending worldwide is projected to grow 20.7%, garnering a total of $591.8 billion in 2023. The current estimate is an increase from 2022 data, which is $490.3 billion in total spending.

| Service | 2021 | 2022 | 2023 |

|---|---|---|---|

| Cloud Business Process Services (BPaaS) | $54,952 | $60,127 | $65,145 |

| Cloud Application Infrastructure Services (PaaS) | $89,910 | $110,677 | $136,408 |

| Cloud Application Services (SaaS) | $146,326 | $167,107 | $195,208 |

| Cloud Management and Security Services | $28,489 | $34,143 | $41,675 |

| Cloud System Infrastructure Services (IaaS) | $90,894 | $115,740 | $150,254 |

| Desktop-as-a-Service (DaaS) | $2,059 | $2,539 | $3,104 |

| Total Market | $412,632 | $490,333 | $591,794 |

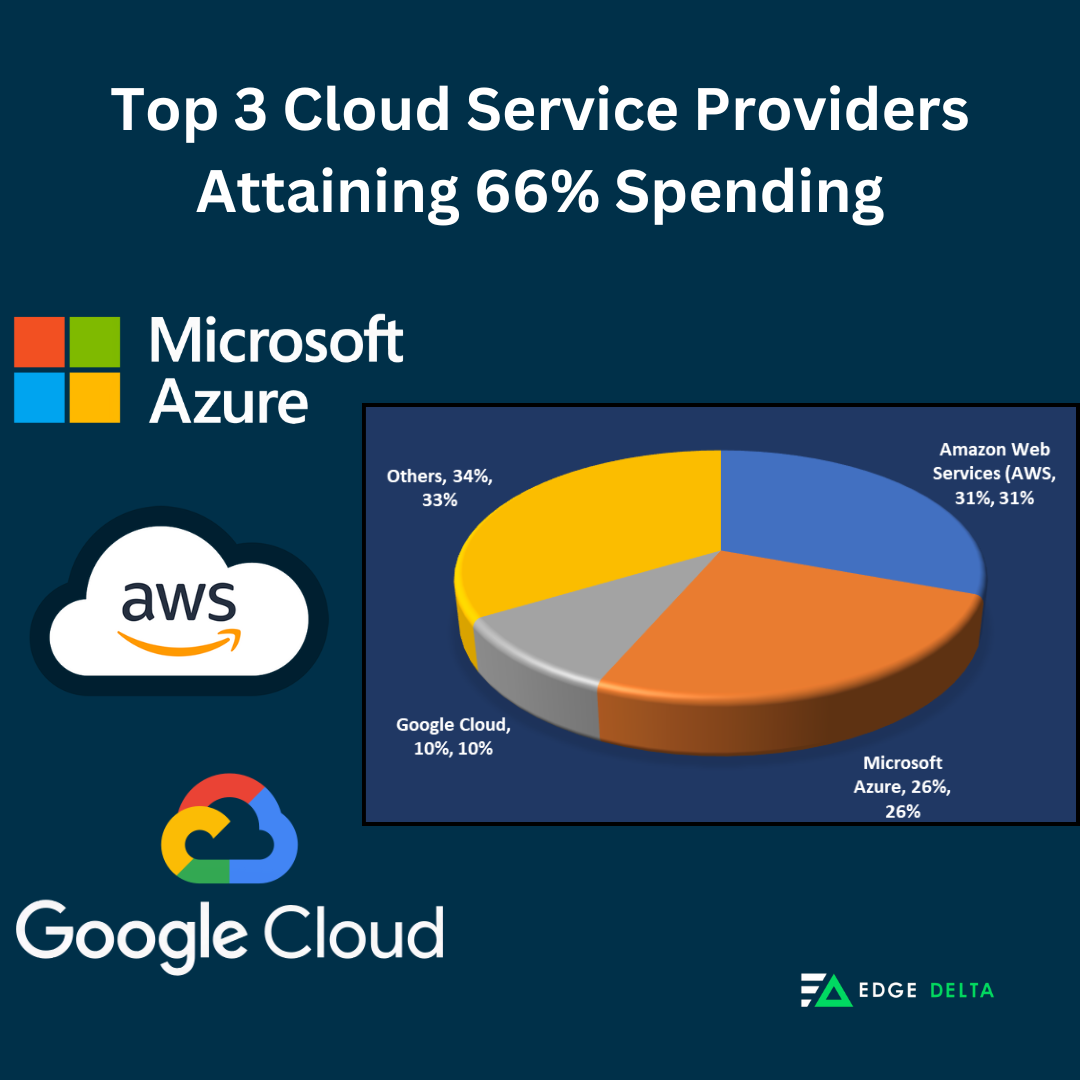

10. AWS, Microsoft Azure, and Google Cloud obtained total spending of 66% in Q4 2023.

(Canalys)

The top 3 cloud service providers comprised of AWS, Microsoft Azure, and Google Cloud grew by 21%, accounting for 66% or $78.1 billion of total spending in Q4 2023. The three companies saw a strong resurgence in revenue growth of over 25%.

With 30% growth, Microsoft significantly outpaced the market and continues to close the gap against AWS. Market leader AWS also witnessed a significant increase in growth compared to the previous quarters. However, its 13% annual rise remains behind the trajectory of Microsoft Azure and Google Cloud.

Wrap Up

Cloud computing has transformed business operations while offering unparalleled opportunities for growth and innovation. The statistics above highlight the widespread adoption of cloud services, the immense growth of the cloud market, and the numerous benefits to various industries of cloud computing.

Businesses can boost flexibility and scalability to cost savings and enhanced productivity as the cloud transforms industries across the globe. With more and more companies leveraging cloud technology, it is clear that the future belongs to the cloud.

Cloud Computing Statistics FAQs

What are the statistics for cloud computing in 2024?

Over 40% of companies have benefitted from deploying cloud computing in their operations. The latest data shows that 39% of companies using the cloud have enabled them to meet their cost-cutting objectives.

Will 85% of organizations be cloud-first by 2025?

According to Gartner, 85% of companies worldwide will embrace the cloud-first principle in 2025. 95% of these will be new digital workloads developed on cloud-native platforms.

How big is the cloud computing market in 2025?

By 2025, experts believe that the cloud computing market will reach $864 billion.