Most businesses analyze 37% to 40% of their data, and 97.2% of companies invest in big data solutions. The unprecedented growth in the volume of data has driven businesses to utilize big data to optimize operational efficiency.

Investments in big data and data analytics have emerged as a critical component for organizations striving to prosper in the era of digitalization. Companies leverage big data to enhance the customer experience and gain a competitive edge.

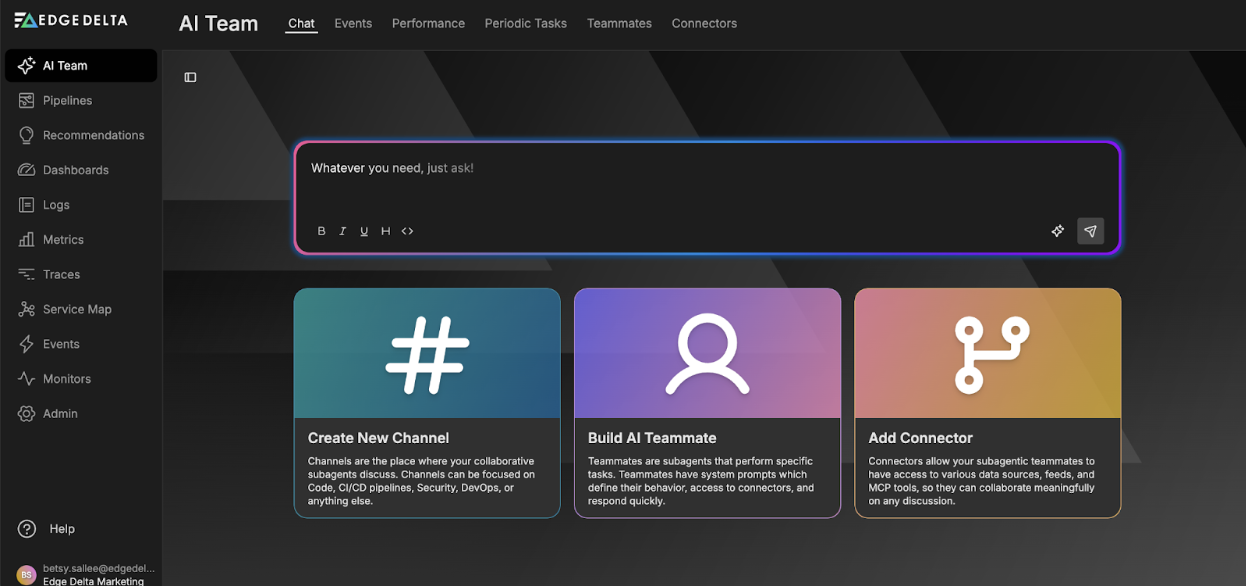

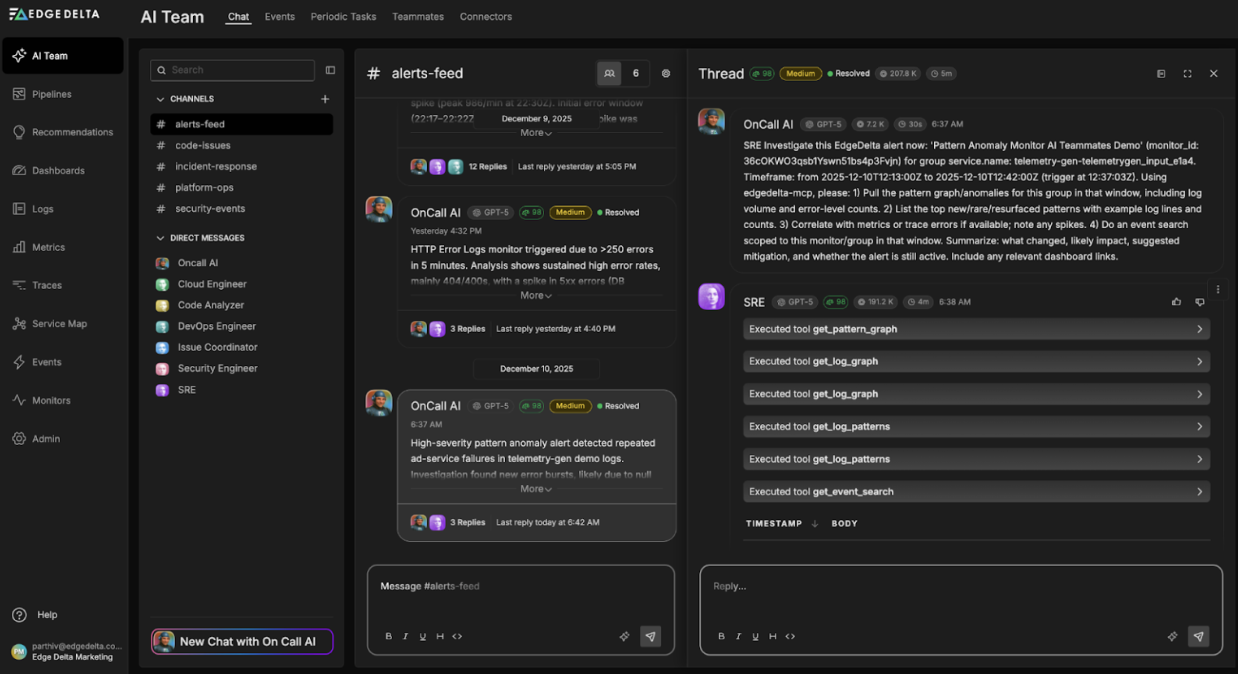

Want Faster, Safer, More Actionable Root Cause Analysis?

With Edge Delta’s out-of-the-box AI agent for SRE, teams get clearer context on the alerts that matter and more confidence in the overall health and performance of their apps.

Learn MoreThis article will explore the breakdown of companies’ big data investments. Discover more about what is big data in the information technology landscape by going through spending trends, predictions, and other relevant statistics.

Read on.

Editor’s Choice

- 66% of data leaders emphasize the role of data and analytics in driving innovation within their organizations.

- Organizations that invest in big data allocate 55% of their budget to IT solutions.

- Over half of companies (52%) opt for project-based funding for big data projects.

- Leveraging big data leads to an 8% increase in revenue.

- Despite economic uncertainties, 56% of data leaders reported increased big data and analytics budgets.

- 78% of data leaders predict an uptick in investment towards 2024.

Investments in Big Data: How Many Companies Are Putting Their Money on It?

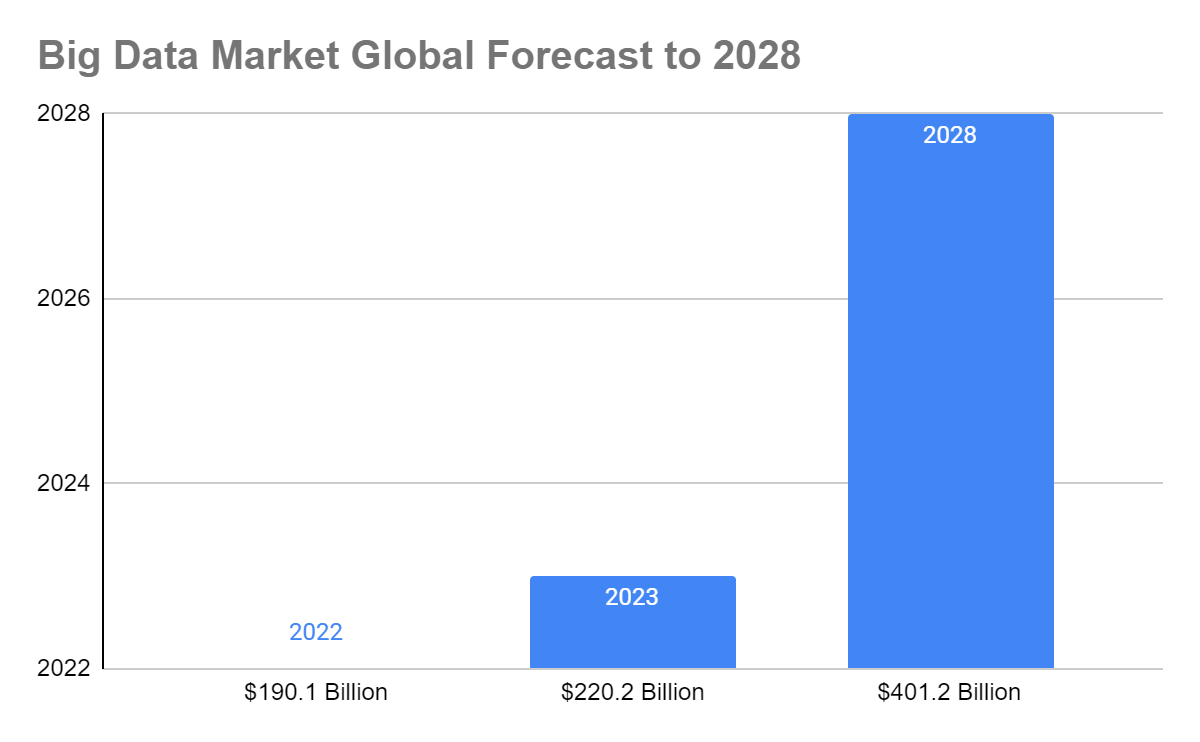

The global big data market is projected to reach $401.2 billion in 2028, up from $220.2 billion in 2023. This significant growth is expected to occur at a CAGR of 12.7% over the forecast period.

Big data is a fundamental component of corporate investment and innovation strategies. The increase in big data investments emphasizes its crucial role in modern business. It highlights the universal recognition of big data’s potential to revolutionize operations, customer engagement, and market strategy.

Check out the interesting statistics on companies’ big data and analytics investments on the next section.

Statical Analysis of Businesses’ Big Data Investments

Companies utilize big data differently, tailoring its use to their specific needs, goals, and operational requirements. They increasingly attempt to use the available data to create better business strategies.

Several factors drive big data investments across industries, causing companies to invest heavily in big data. These factors are:

- Improve Decision-Making: Businesses want to improve their decision-making processes by incorporating data-driven insights that can lead to more precise and strategic business decisions.

- Gain Competitive Advantage: Access to big data allows businesses to identify trends and patterns that can give them a competitive edge in the market.

- Improve Customer Insights: Understanding customer behavior, preferences, and trends is crucial for tailoring products and services to meet market demands, enhancing customer satisfaction and loyalty.

- Optimize Operations: By analyzing massive amounts of operational data, companies can find inefficiencies and improve productivity, lowering costs.

- Drive Innovation: Big data analytics can uncover new opportunities for product development and innovation, helping companies stay ahead in rapidly changing industries.

- Risk Management: Big data tools can help predict and mitigate risks by analyzing historical data and identifying potential issues before they escalate.

Explore the numbers below to learn how big data changed the business world.

1. Competitive Advantage: 66% of executives are leveraging data to foster innovation in 2023

(Statista)

A 2023 survey revealed that most executives said high-end technologies used in their companies’ digital transformation had a positive impact. Data and analytics, in particular, have the most positive effect and increase profits or performance.

2. Operational Improvements: Companies using big data invest 55% of their budgets in IT solutions.

(BARC)

In companies that already use big data, 55% of their investments go toward increasing the budget for IT solutions. The top priority is developing technical requirements. Companies are also investing 48% of the budget in training existing staff and hiring new staff.

Here’s how companies allocate big data investments:

| Investment Type | Percentage |

|---|---|

| Budget for IT solutions | 55% |

| Training of existing staff | 48% |

| Staff increase/Creation of new posts | 30% |

| External technical consulting | 26% |

| External analytical/line of business | 24% |

| Creating separate organizations | 20% |

| No new investments | 7% |

| Others | 2% |

3. Customer Insights: Data-driven organizations are 23 times more likely to acquire customers.

(McKinsey and Company)

In terms of ROI for big data and analytics investments, data-driven organizations are 23 times more likely to reach customers. They are also six times more likely to retain customers and 19 times more likely to be profitable.

Leveraging data enables businesses to make better decisions and enhance the customer experience, which leads to satisfied customers who continue to return for more.

4. Innovation: Businesses that use big data experience an 8% increase in their revenue.

(BARC)

Organizations that used big data reported an increase in revenue equivalent to 8%. They also reported a reduction in expenses by 10%. The companies listed the following benefits that emerged when they transitioned to utilizing big data:

- 69% cited better strategic decisions

- 54% said that big data improved their control of operational processes

- 52% stated that they better understood their customers

5. Data Dilemma: 68% of data leaders said centralized IT consumes 20% of their data management budget.

(Informatica)

While data investments come from different sources, 2 out of 3 data leaders say centralized IT departments mainly bear data investment costs. Data management organizations come close at 59% and spend 20% of their data management budget.

6. Project-Powered: 52% of companies fund their big data initiatives on a project basis.

(BARC)

More than half of companies fund their big data initiatives project-by-project. If it is part of the process, the funding comes from the IT budget (46%). This suggests that a technical topic is what drives big data the most.

Here’s the table showing how big data and analytics are being funded:

| Funding Source | Percentage |

|---|---|

| Project-based Funding | 52% |

| IT Budget | 46% |

| Research/Innovation | 31% |

| Line of Business | 30% |

| Others | 2% |

Big Data Spending Trends and Predictions

Big data is gaining traction owing to rising investments and government and private players spending on various technological projects. Spending on big data technology will rise by 1.6 times in 2025.

Additionally, the following drive boosts big data spending:

- Rising internet penetration

- 5G infrastructures

- Growing adoption of technologies (Cybersecurity, loT, etc.)

Here are some spending trends and predictions to know how companies use big data:

7. Spending Trend: More than half (56%) of data leaders increased their budget in 2023.

(Atlan)

Only 8% of respondents reported that their budget had been reduced, while 36% of leaders had their budget reviewed. Despite the recent economic uncertainty, organizations continue to value data and analytics.

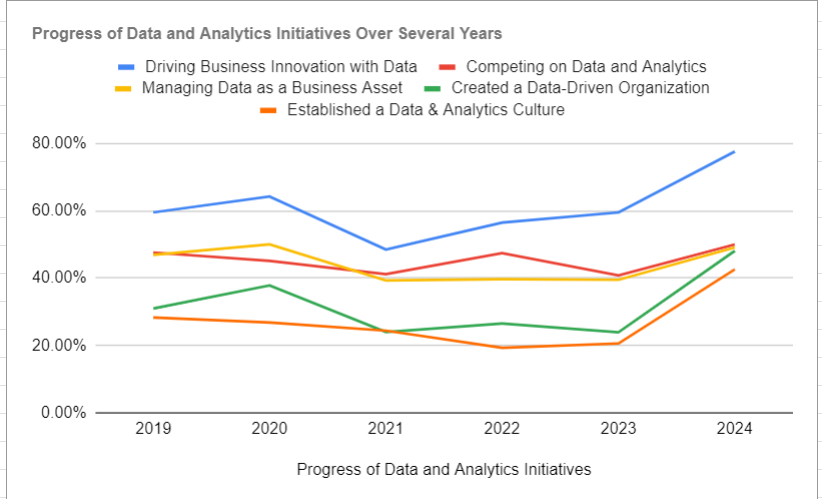

8. Innovation Surge: Organizations driving business innovation from data jumped from 59.5% to 77.6%.

(WaveStone)

Big data statistics 2023 revealed that Fortune 1000 businesses showed a sharp improvement. An 18.1% increase in data-driven innovation shows a strategic use of data for competitive advantage and growth.

Furthermore, the proportion of organizations reporting having created a data-driven organization has more than doubled, from 23.9% to 48.1%. Here’s a graph showing the progress of data and analytics initiatives over several years:

9. Priority Analytics: 87.9% of organizations prioritize data and analytics investment.

(WaveStone)

The results indicate a strong consensus on the strategic importance of big data and analytics capabilities. Additionally, 84.3% stated that strong business leadership and partnerships were in place within their organization.

10. Executive Boost: 82.2% of executives confirmed that their organizations are increasing their big data and analytics investments.

(WaveStone)

Despite a slight drop from last year (87.8%), corporate data and analytics investment continues to grow. Businesses continue to use data to inform strategies, improve customer experiences, and forecast future trends, demonstrating analytics’ industry-wide utility.

11. Data Dividends: 87% of organizations reported measurable business value from data and analytics investments.

(WaveStone)

There was a slight decrease (4%) in the number of businesses that saw the benefits to various big data industries. In the past years, 91.1% and 92.1% of companies benefited from data and analytics investments. However, only 48.4% saw an ROI in 2017.

12. Data Majority: 4 out of 10 companies use big data analytics.

(Trendswatch)

Only 40% of businesses use big data analytics, indicating a slower adoption rate. However, a significant shift is underway, with 90% of companies intending to increase their data and analytics budgets in 2023.

13. Spending Prediction: 78% of data leaders predicted increased data investment in 2024.

(Informatica)

The forecasted increase demonstrates an interest in solutions that solve AI adoption challenges. Moreover, 45% of data leaders have already implemented generative AI, and another 54% plan to do so. 99% of AI adopters plan to use AI to manage their data requirements.

14. Universal Commitment: 100% of respondents plan to invest in data management capabilities.

(Informatica)

All data leaders invest in data management capabilities, indicating their potential to solve data strategy issues. Nearly half of respondents (48%) said they would consider training or retraining their employees in AI or machine learning.

15. AI Priority: 62.3% of data leaders view generative AI as a top organizational priority.

(Wavestone)

Despite the early adoption, companies see generative AI as the most transformative technology in a generation. This is further reflected in the 89.6% of organizations increasing their investments in generative AI.

Conclusion

Data leaders recognize big data and analytics as crucial forces in today’s digital landscape for their ability to reshape industries. Companies leveraging big data gain a competitive edge through smarter decisions, superior customer insights, and enhanced efficiency.

The increasing investments and strategic focus on big data analytics highlight their indispensable role in fostering business innovation and growth. As big data spending rises, data analytics is essential for long-term success.

FAQs on Data and Big Data Investments

How much do data analytics services cost?

Small to medium-sized companies invest from $40,000 to $ thousand a year in data analytics.

How fast is the big data market growing?

The big data market is continuously growing at a CAGR of 12.7%. In 2028, it is expected to be worth $401.2 billion.

How big is the market for big data?

In 2023, the big data market is worth $220.2 billion.

Sources