Summary

In this article, we conduct an ROI analysis of using Edge Delta. This piece provides a rough estimate of how much you can save with Edge Delta – it is not a one-size-fits-all analysis.

The customer we cite in this article saw:

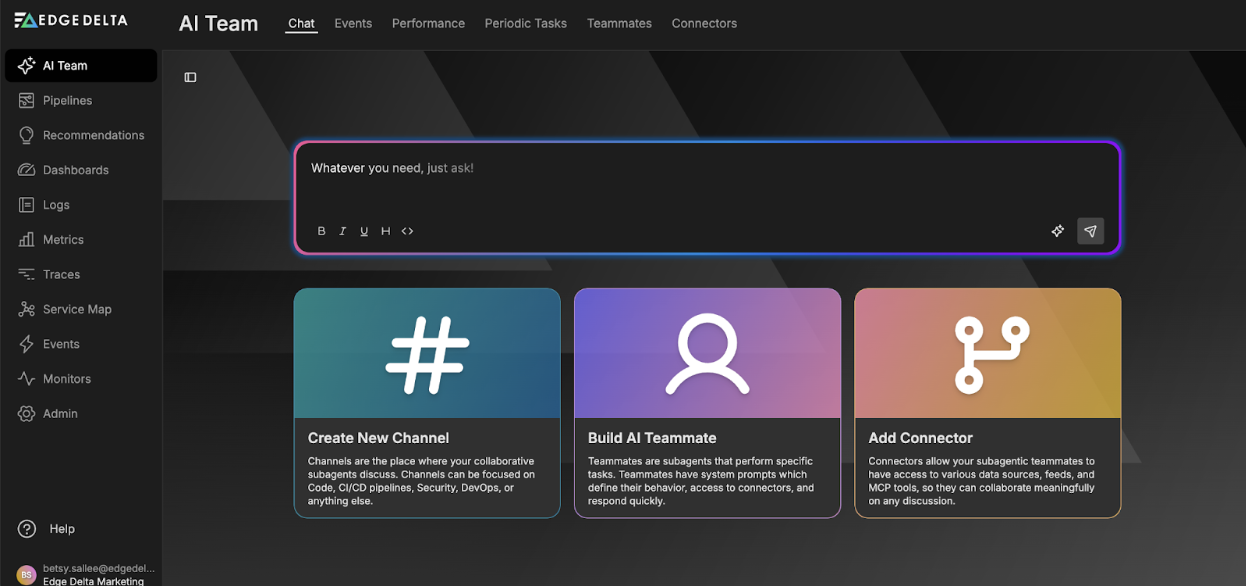

Want Faster, Safer, More Actionable Root Cause Analysis?

With Edge Delta’s out-of-the-box AI agent for SRE, teams get clearer context on the alerts that matter and more confidence in the overall health and performance of their apps.

Learn More- Nearly 300% ROI with Edge Delta

- $10.24M in Splunk savings over a three-year period

Introduction to the Edge Delta ROI Analysis

When prospects evaluate Edge Delta to create observability pipelines, they typically want to reduce the cost of their downstream observability platforms — tools like Splunk, Elastic, or Datadog.

Thus, it’s critical to present a defensible ROI analysis in our engagements. Here, I will share our methodology for building that report. At the end, I’ll also provide a real-world example demonstrating how much a customer saved.

Before doing so, I want to be clear about the intended use of this article. Frequently, prospects new to Edge Delta want a ballpark number of what they can save by using our product. This blog post aims to provide this information. But, each customer’s ROI is dependent on several factors unique to them. The outcomes included in this blog cannot be applied universally.

Request a demo

How We Measure ROI

When you create observability pipelines with Edge Delta, you begin processing your log data as it’s created at the data source. Before, you would ingest raw datasets into your observability platform and perform analysis post-index. However, with Edge Delta, you ingest optimized datasets made up of lightweight analytics and raw data your team needs for monitoring and troubleshooting.

The end result is that customers are recalibrating the cost-to-value ratio of their log analysis tools. Before, they’d pay huge sums to ingest their raw data — whether they’re team needed that data or not. (When we talk to customers, we often here they access less than 10% of what they index.)

Now, their budget is allocated towards their most valuable data — and not all their extraneous data. This approach can help you realize ROI in a few ways:

Reduction in overages

With Edge Delta in place, you’ll start processing log data upstream, before it’s ingested in your observability platform. As a result, you will stop seeing random spikes in data that lead to overages. When Fama cut out their overages, they were able to reduce their Datadog bill by over 60%.

Reduction in license costs

If you’re in the process of procuring or renewing an observability license, Edge Delta can help you right-size your data footprint to control costs. Webscale took this approach and adopted Edge Delta while evaluating new observability platforms. As a result, they were able to procure Sumo Logic at a cost that fit within their budget.

Right-sizing infrastructure costs

If you’re using open source or self-hosted observability tools, Edge Delta can help you optimize resource consumption. This is the case for Super League Gaming, who optimizes their log data by 99% before ingesting in their Loki instance.

Guide: Data Optimization without Compromise

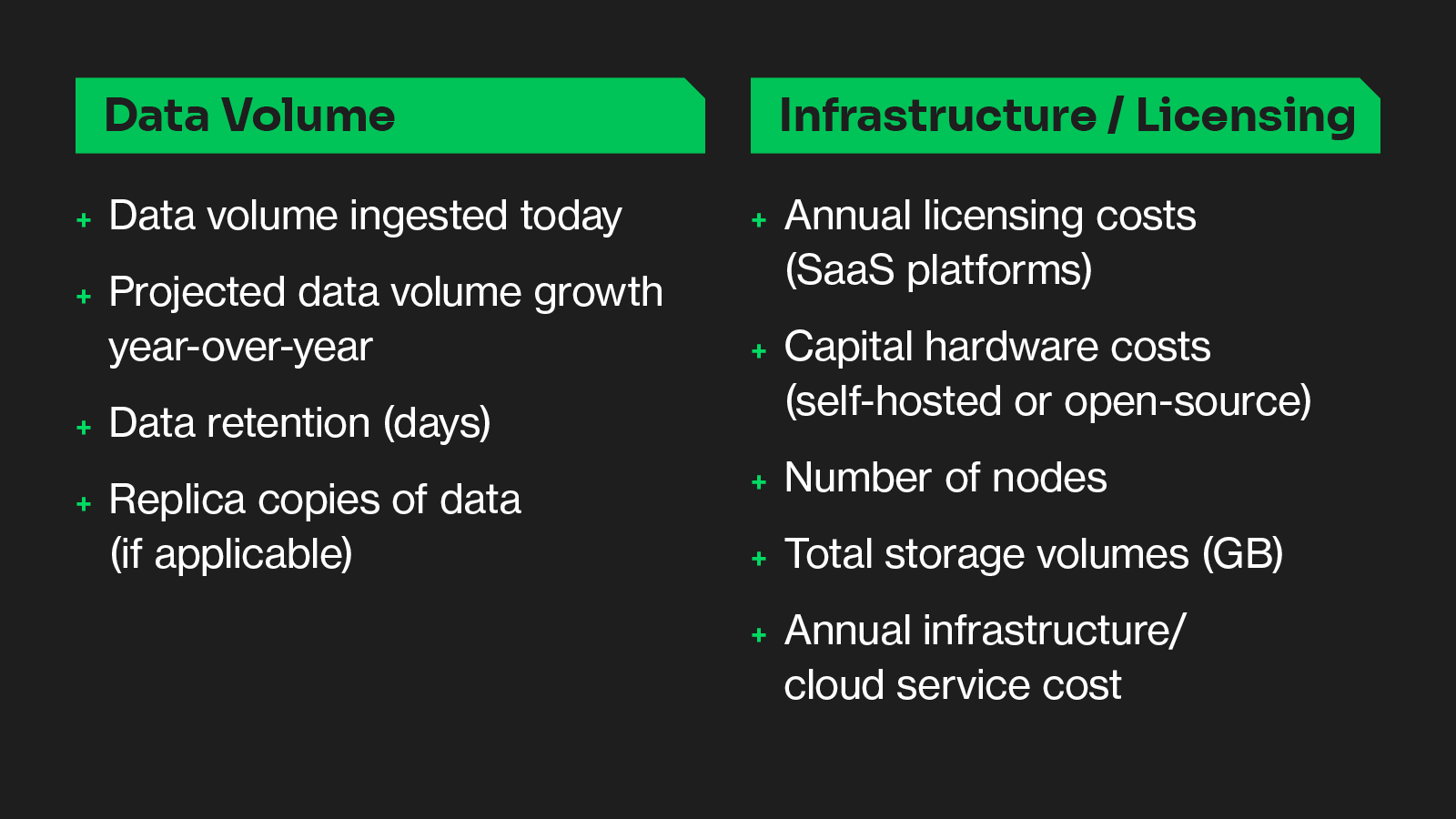

ROI Analysis Inputs

To calculate the ROI analysis, our team takes into account the following cost factors:

Real-World Example

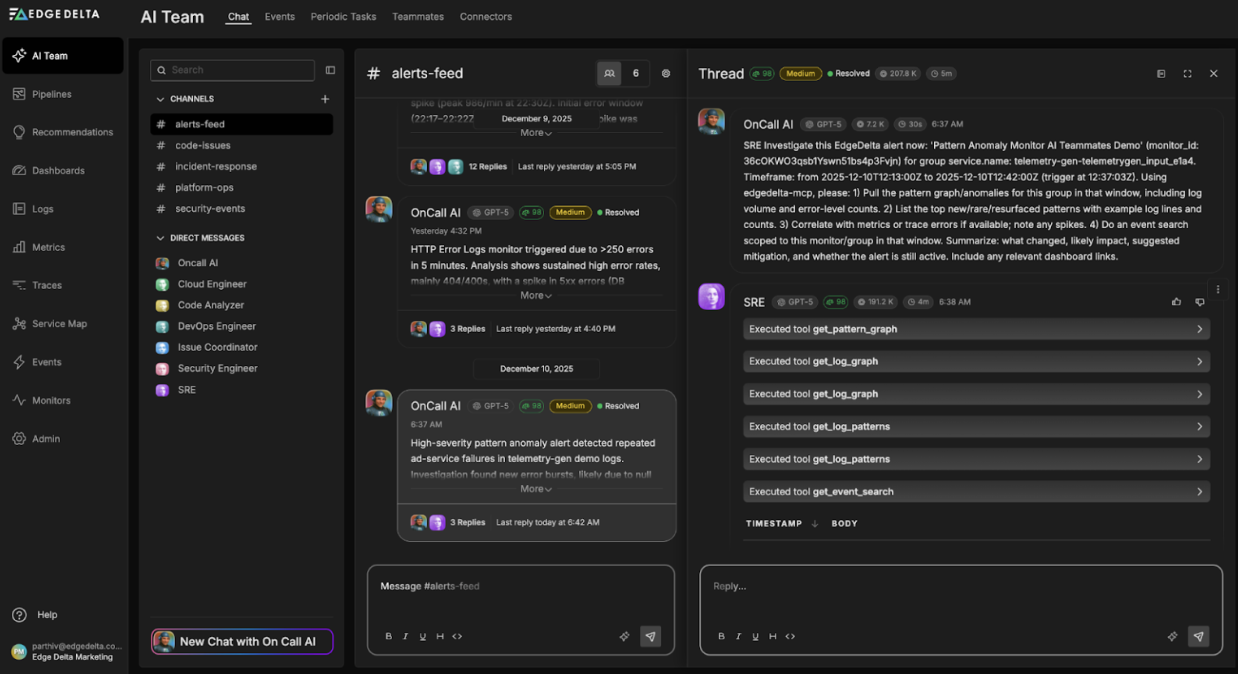

In this section, we’ll walk through a real-world example of a Splunk customer who has completed the ROI analysis. This customer had a Splunk agreement in place, using Splunk Virtual Credits (SVCs). SVC is a workload-based, which you can read more about here. This customer evaluated Edge Delta purely for data optimization and cost savings.

To complete the ROI analysis, we captured the following data points about the customer’s Splunk usage:

Data Volume

- 12TB/day ingestion

- 20% annual data volume growth

- 30-day data retention

Infrastructure / Licensing

- ~$5.3M in total annual Splunk spend

- ~$866k in Splunk storage costs

- 1272 current max SVC usage

- 4200 projected max SVC usage

Throughout this customer’s proof of concept, they were able to optimize log ingest by 86.3%. To be conservative with our estimates, we conducted the analysis with 80% data optimization.

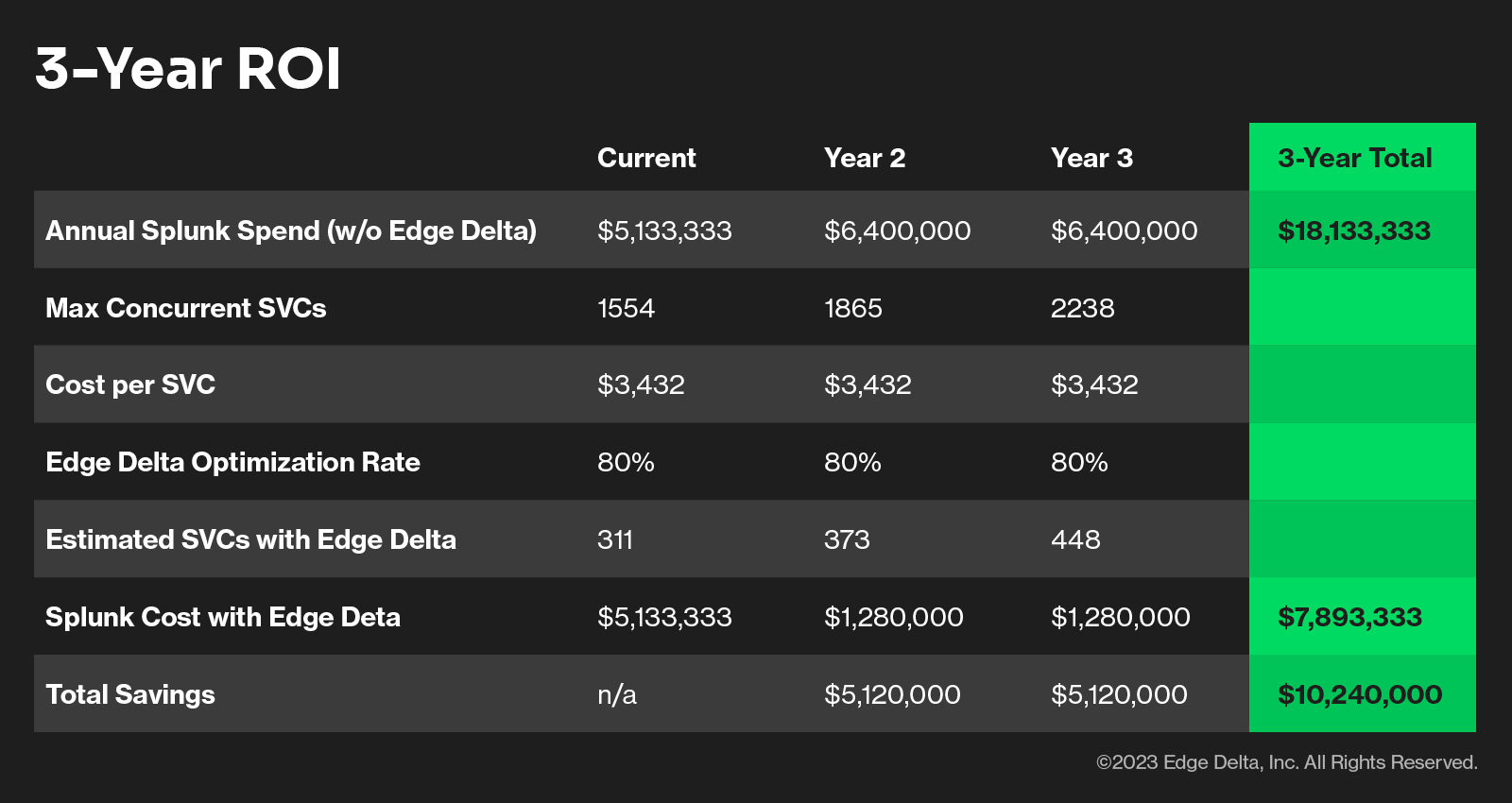

The following table demonstrates the ROI that this customer will realize in hard cost savings over the course of three-years.

Since this customer already had a Splunk agreement in place during the first year of their Edge Delta engagement, they did not see any savings. However, over the next two years, they would save $10.24M.

This added up to a nearly 300% ROI on their Edge Delta agreement over the course of the contract. Additionally, it opened up the potential to ingest datasets into Splunk that the company had previously dropped.

Conclusion

Edge Delta can help you reduce the TCO of your observability tools, as was the case with the Splunk customer above.

There are several other positive business outcomes that are hard to include an analysis like this:

- Consolidating agents and routing infrastructure.

- Eliminating vendor lock-in by enabling open observability.

- Detecting production issues faster than is possible when centralizing data before alerting on it.

Additionally, Edge Delta can help you realize “soft” cost savings by automating and/or simplifying observability processes. For example, you can…

- Reduce monitoring toil by populating dashboards without having to constantly maintain queries.

- Create alerts faster by not having to predict potential production issues or configure monitors.

- Troubleshoot issues in a fraction of the time by surfacing all relevant data and impacted components when an alert fires.

All in all, Edge Delta can help you shift the cost-to-value ratio of your observability stack back into your favor.