Log retention matters more than ever for businesses today. You have to satisfy regulators, keep operations running smoothly, and manage storage costs without breaking the bank. Get it wrong, and you’ll face serious financial consequences. Just look at February 2024, when the SEC fined 16 firms a combined $81 million for failing to properly retain electronic communications.

The challenges are real. Different regulations like GDPR, HIPAA, and SOX often conflict with each other. Storage costs continue to rise with significant annual data growth. IT teams struggle to meet legal requirements while maintaining efficient system operation. Poor retention gets you fined, ruins your legal cases, and sends costs through the roof.

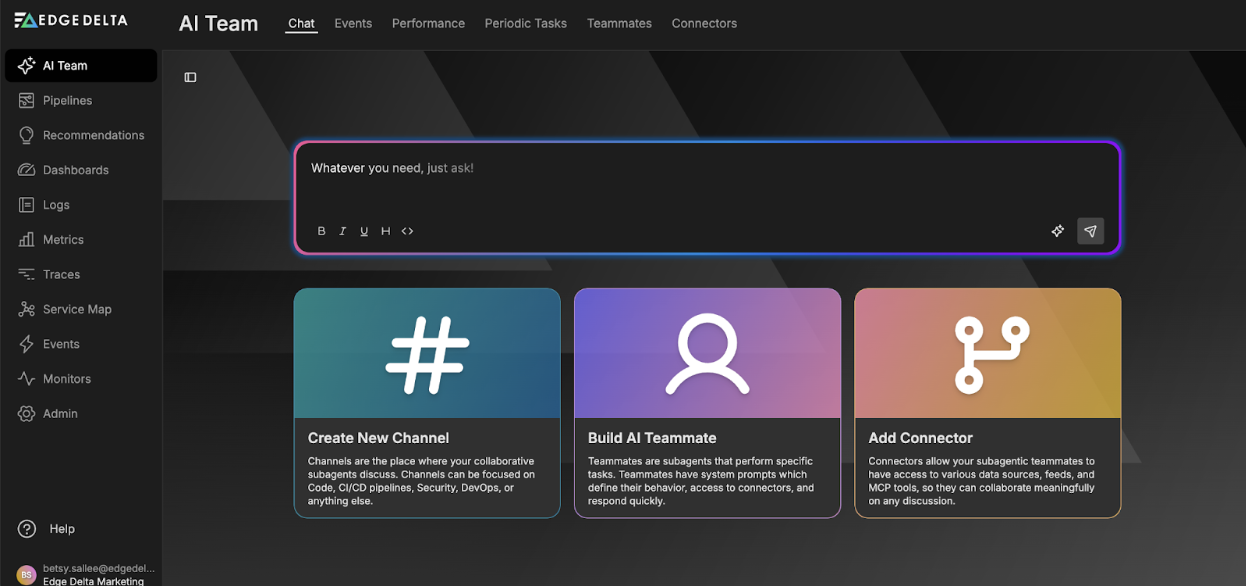

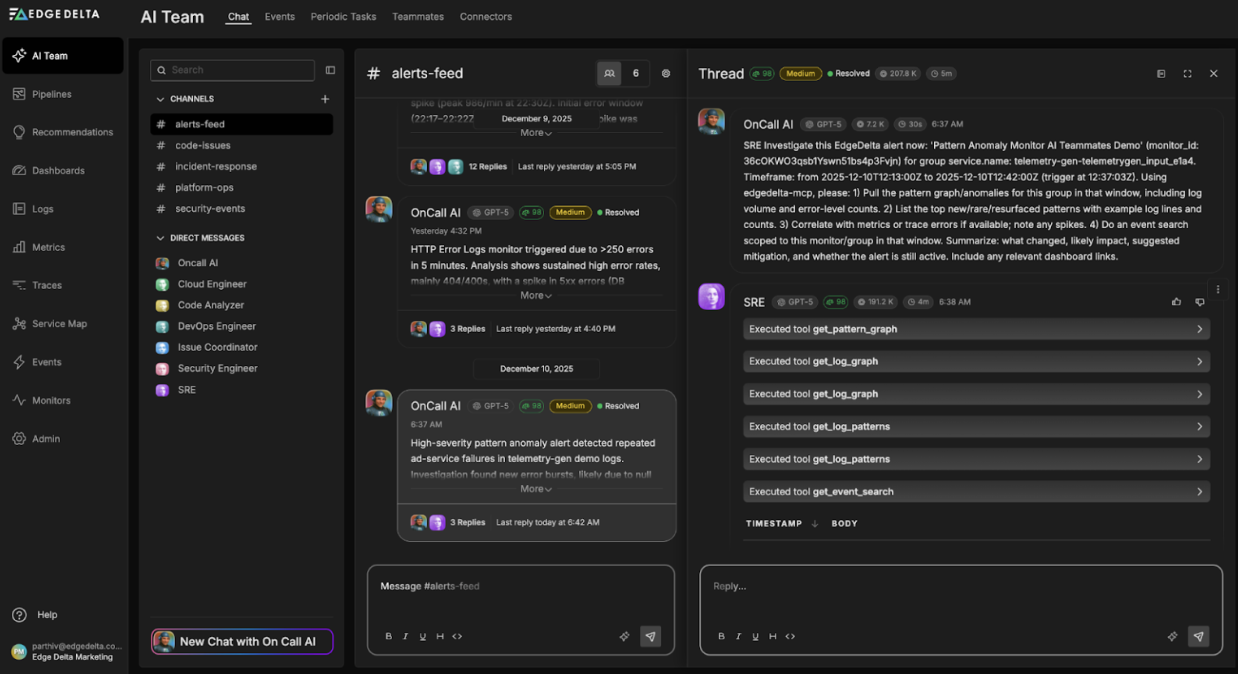

Automate workflows across SRE, DevOps, and Security

Edge Delta's AI Teammates is the only platform where telemetry data, observability, and AI form a self-improving iterative loop. It only takes a few minutes to get started.

Learn MoreThis guide walks you through retention basics, compliance rules, policy creation, implementation tactics, and ways to keep costs down. If you’re starting from scratch or improving existing policies, you’ll need a robust, compliant, and cost-effective retention strategy.

Understanding Log Retention Fundamentals

Log retention is the practice of keeping digital log data for specific periods to meet business needs, legal obligations, and technical requirements. While backups help you recover from disasters, log retention preserves your historical records so you can analyze trends, pass audits, and stay compliant with regulations.

Understanding different log types and formats is essential for developing effective retention strategies, as various log categories require different treatment based on their content and regulatory importance.

A comprehensive retention strategy includes four components:

- Retention periods: How long different log types must be preserved

- Storage methods: Where and how logs are archived

- Archival processes: Transitioning active logs to long-term storage

- Deletion policies: Secure disposal when retention expires

If you’re wondering how it’s different from backups, here’s a quick explanation:

Backups focus on system recovery (typically 30 days). Meanwhile, log retention preserves historical data for compliance and analysis (often for years). For example, database logs might be backed up for 30 days. However, they should be retained for seven years to meet financial audit requirements.

Why Log Retention Matters

Organizations implement retention policies for the following critical reasons:

- Regulatory Compliance

Different industries have tough rules to follow. Healthcare companies must keep audit logs for 6 years under HIPAA. Financial firms need to store transaction logs for varying periods depending on the specific regulation and record type.

- Security Investigation

Hackers often lurk in systems for months before anyone notices. Security teams need old logs to figure out when attacks started and how far they spread. Proper log management in high-volume environments is crucial for maintaining security visibility without breaking the budget.

- Operational Troubleshooting

Network engineers analyzing intermittent issues need months of performance data to identify patterns. Application teams investigating rare software defects rely on comprehensive log archives.

- Legal Protection

Proper retention demonstrates due diligence during audits and provides litigation protection.

Legal and Compliance Requirements

Log retention rules change dramatically depending on your industry and location, making compliance a real headache for businesses. You need to know the compliance requirements and regulations that apply to you and what they actually require, so you can build policies that keep you out of trouble while still meeting your day-to-day needs.

- Major Regulatory Frameworks

Here’s how the biggest regulations affect your log retention requirements and what you need to do to stay compliant.

GDPR: Sets rules for keeping personal data only when you actually need it. The “right to erasure” makes things tricky when personal information gets mixed into your logs, forcing you to juggle compliance requirements with people’s deletion rights.

SOX (Sarbanes-Oxley Act): Requirements vary by section and record type:

- Section 802: Requires accountants to retain records for a minimum of 5 years

- SEC regulations under Section 103: Mandate 7 years for audit workpapers and related documents

- General financial records: Publicly traded companies typically need 7-year retention for comprehensive audit trails and financial reporting documentation

HIPAA: Healthcare organizations must retain audit logs documenting PHI access for six years (longer in some states). Authentication logs, database access records, and application usage logs become critical compliance artifacts.

PCI DSS: Merchants and service providers retain audit logs for at least one year, with three months immediately accessible. Must log access to cardholder data, administrative actions, and security events.

SEC & Industry Standards: Financial institutions face additional requirements for electronic communications and trading records. Sector-specific standards (NERC CIP for utilities, FDA for pharmaceuticals) add specialized obligations.

- Retention Periods by Industry

Here’s how long different industries need to keep their logs to stay on the right side of the law.

| Industry | Log Type | Retention Period | Notes |

| Healthcare | Audit logs | 6-7 years | Most standard audit logs |

| Medical device/clinical trial data | 15-25 years | Depends on regulations and litigation risk | |

| Financial Services | Banking logs | 7 years | SOX compliance |

| Investment advisor logs | 3 years | SEC requirement | |

| Broker-dealer logs | 6 years | First 2 years must be immediately accessible | |

| Government | Routine operational logs | 3 years | NARA schedules |

| Historically significant records | Permanent | NARA schedules | |

| Telecommunications | Traffic and location data | 6 months – 2 years | EU directives, subject to legal challenges |

- International Considerations

Organizations juggle conflicting retention rules across different countries. Data residency laws force you to keep citizen data within specific borders, making centralized management harder and more expensive.

When you need to move data across borders, you’ll have to follow Standard Contractual Clauses or adequacy decisions, especially when transferring from strict privacy regions to places with weaker protections.

Disclaimer: Consult qualified legal counsel for specific compliance requirements.

Types of Log Data and Retention Considerations

Different log types have unique retention requirements based on their content, compliance needs, and operational value. Understanding the three pillars of observability helps contextualize how logs fit into your broader monitoring and compliance strategy.

| Log Type | Priority | Retention Period | Key Examples | Compliance Drivers |

| Security and Access Logs | Highest | 1-7 years | Authentication logs, firewall logs, intrusion detection alerts | PCI DSS (1 year), HIPAA (6 years), Financial regulations |

| Application and System Logs | High | 30 days – 2 years | Error logs, performance metrics, system events | Varies by log type and industry |

| Business Transaction Logs | High | 3-7 years | Financial transactions, customer interactions, payment processing | SOX (5-7 years), consumer protection laws |

| Diagnostic and Performance Logs | Medium | 7-90 days | CPU utilization, memory consumption, network metrics | Minimal compliance requirements |

- Security and Access Logs

Why longest retention: Advanced threats remain undetected for months. These logs provide irreplaceable forensic evidence.

Specific requirements:

- PCI DSS environments: 1 year (3 months immediately accessible)

- Healthcare (HIPAA): 6 years for access logs

- Financial institutions: Often longer due to regulatory requirements

- Application and System Logs

Operational heartbeat: Track error conditions, performance metrics, and configuration changes.

Tiered approach:

- Debug logs: Days to weeks

- System modification audit trails: Multiple years

- Web server access logs: Months for capacity planning

- Database audit logs: Multi-year for financial compliance

- Business Transaction Logs

Special handling: Often contain PII and financial data requiring careful management. Integration needs: Must align with broader business record-keeping policies for consistency.

- Diagnostic and Performance Logs

- High-volume challenge: Provide granular insights but limited long-term value.

- Cost optimization: Aggressive purging policies minimize storage costs while maintaining operational capabilities. Performance data often aggregated for trends while raw logs are purged quickly.

Creating a Log Retention Policy

Building an effective log retention policy requires mapping your compliance requirements, business needs, and technical constraints into clear, actionable guidelines. Let’s look into the entire process:

Policy Development Process

The following are 4 core steps in developing a log retention policy:

- Stakeholder Collaboration: Include legal counsel (regulatory interpretation), compliance officers (industry requirements), IT administrators (technical feasibility), security teams (forensic needs), and business units (operational requirements). Each brings critical perspectives: legal identifies compliance periods, security advocates for forensic capabilities, and finance pushes cost optimization.

- Requirements Gathering:

- Catalog regulatory requirements (SOX, HIPAA, GDPR, PCI DSS)

- Assess operational needs for troubleshooting and analysis

- Consider state and international regulations

- Risk Assessment: Weigh the consequences of inadequate retention (penalties, litigation disadvantages) against extended retention risks (data breach exposure, storage costs).

- Policy Documentation: Translate complex requirements into clear, actionable statements specifying retention periods, storage requirements, access controls, and deletion procedures.

7 Key Policy Components

Every effective retention policy includes these essential elements to ensure comprehensive coverage and clear guidance.

- Data Classification: Categorize logs by sensitivity, regulatory requirements, and business value. Security logs need extended retention for forensics; diagnostic logs require brief preservation.

- Retention Schedules: Specify exact periods for each category:

- Financial transaction logs: 5-7 years (depending on SOX section)

- Application debug logs: 30 days

- Account for legal holds and extension flexibility

- Storage Tiers: Define progression from hot → warm → cold storage based on age and access frequency. Example: Security logs in hot storage (90 days) → warm storage (1 year) → cold storage (remainder).

- Access Controls: Implement least-privilege principles with approval procedures for archived log access, audit trails for requests, and emergency access procedures.

- Deletion Procedures: Establish secure disposal methods with verification requirements, compliance certificates, and failure handling procedures.

- Review Cycles: Annual policy reviews for regulatory changes, retention effectiveness, and cost optimization. Incorporate lessons from audits and investigations.

- Exception Handling: Address litigation holds, investigations, or regulatory inquiries requiring extended retention with clear approval processes.

Implementation Considerations

Successful policy deployment requires careful planning around technical constraints, organizational change, and ongoing management needs.

- Technology: Align with policy objectives: automated retention management, secure deletion, compliance reporting. Need log management platforms with lifecycle policies and tiered storage.

- Training: Technical staff need policy configuration training; business users need access procedure awareness.

- Monitoring: Automated compliance checking, regular audits, and violation detection across all log sources.

- Documentation: Maintain audit-ready records of policy decisions, implementation activities, and retention actions.

Storage Technologies and Strategies

Choosing the right storage approach can dramatically reduce costs while keeping your logs accessible when you need them. Managing high-volume logs effectively requires understanding both the technical and cost implications of different storage strategies.

Storage Tier Strategies

Different storage tiers balance cost and accessibility, with automated policies moving logs through tiers as they age.

| Storage Tier | Duration | Access Time | Cost Savings | Use Cases |

| Hot Storage | 30-90 days | Milliseconds | Baseline cost | Active analysis, real-time monitoring |

| Warm Storage | 3-12 months | Minutes | 50-70% reduction | Monthly reviews, quarterly audits |

| Cold Storage | 1-7 years | Hours | 90%+ reduction | Compliance archival, rare forensic investigations |

| Archive Storage | Long-term | 12+ hours | $0.004/GB monthly | Compliance-only scenarios |

| Automated Tiering | All phases | Variable | 60-75% average (80-90% possible) | Lifecycle management |

Storage Technologies

Choose storage technology based on your performance needs, budget, and how often you’ll access archived logs.

- Cloud Solutions: AWS S3 (Standard to Glacier Deep Archive), Azure Blob Storage, Google Cloud Storage offer 95% cost reductions through automated transitions with unlimited scalability.

- On-Premises: SANs for hot storage performance, NAS for cost-effective warm storage, tape libraries for air-gapped archive storage with extremely low per-GB costs.

- Hybrid Approaches: Local infrastructure for recent logs, cloud for long-term retention. Addresses data sovereignty while optimizing costs and disaster recovery.

- Object Storage: Scales to exabytes with consistent performance and rich metadata for retention management.

- Compression/Deduplication: 70-90% space savings for log data with inline processing that doesn’t impact performance.

Retention Automation

Automated systems handle the heavy lifting of retention management, reducing manual work while ensuring consistent compliance.

- Lifecycle Management: Automated tier transitions based on age and access patterns. Example policy: “security logs to warm storage after 90 days, cold after one year, delete after seven years.”

- Retention Enforcement: Automated deletion with retention verification, legal hold checks, and compliance documentation generation.

- Metadata Management: Centralized tracking of retention status, access history, and compliance requirements across distributed infrastructure.

- Compliance Reporting: Automated reports showing retention rates, storage utilization, and policy violations to support audits and reduce administrative overhead.

Implementation Best Practices

Successful retention programs follow proven practices that minimize risk while maximizing efficiency and compliance.

Planning and Design

NIST SP 800-92 emphasizes structured planning for cybersecurity log management that meets federal compliance standards. Thus, proper upfront planning prevents costly mistakes and ensures your retention strategy aligns with business and regulatory needs.

- Start with Compliance: Catalog all regulations, standards, and contractual obligations as your baseline. This compliance-first approach prevents costly remediation and ensures audit readiness.

- Plan for Growth: Model realistic annual data growth over 5-7 years based on current industry trends. Account for retention period extensions and potential acquisitions that could dramatically increase volumes.

- Design for Automation: Achieve 95% automated retention management. Platforms like Splunk, Elastic Stack, or cloud-native solutions handle lifecycle transitions, deletion scheduling, and compliance monitoring without manual intervention.

- Integrate with Data Governance: Align retention policies with existing data classification, privacy measures, and records management to avoid conflicts.

- Budget Holistically: Allocate 15-25% of storage budget to retention. Model storage tier transitions: Archived logs cost 90% less but may have significant retrieval fees.

Technical Implementation

The right technical approach ensures your retention system works reliably while staying within budget and performance requirements.

- Standardize Log Formats: Consistent timestamps, metadata schemas, and field structures enable automated classification and lifecycle management across all systems.

- Implement Strong Access Controls: Role-based permissions, least-privilege principles, multi-factor authentication for archive access, and detailed audit trails of all access attempts.

- Ensure Data Integrity: Cryptographic checksums, digital signatures, and automated integrity validation with alerts for corruption or tampering.

- Plan Disaster Recovery: Geographic distribution, backup verification, and quarterly restoration testing to ensure archived logs remain accessible after failures.

- Monitor Compliance: Automated dashboards tracking retention adherence rates, storage utilization, and policy violations with alerts for approaching deadlines.

Operational Best Practices

Day-to-day management practices keep your retention program running smoothly and adapting to changing needs.

- Regular Reviews: Annual assessments of regulatory changes, cost analysis, and lessons learned. Update policies with stakeholder approval.

- Staff Training: Cover policy requirements, technical procedures, and escalation processes. Maintain documentation and conduct competency assessments.

- Document Everything: Implementation decisions, exception approvals, and retention actions. Create meta-retention requirements for retention-related records.

- Test Restoration: Quarterly tests to verify functionality, measure retrieval times, and validate data integrity across storage tiers.

Cost Management and Optimization

Controlling log retention costs while meeting compliance requirements requires smart storage strategies and automated lifecycle management.

Cost Factors

Organizations generate 10-50 GB daily per server. Seven-year vs. one-year retention can significantly increase costs. Access frequency determines storage tier needs.

Optimization Strategies

- Automated tiered storage based on age and access patterns

- Compression: 70-80% storage reduction

- Deduplication: 60-90% space savings for system logs

- Log sampling techniques: Intelligent data reduction while maintaining visibility

Example Cost Calculation (1TB monthly, 7-year retention)

- Hot storage (3 months): $69/month

- Warm storage (9 months): $112.50/month

- Cold storage (78 months): $78/month

- Total: $259.50/month vs. $1,610 for all-hot storage

Budget Planning

Model realistic annual growth over 5-7 years based on current industry trends. Cloud costs decrease 10-20% annually while on-premises remain stable, favoring cloud strategies.

ROI Considerations

Balance compliance costs against penalty avoidance and operational insights. Proper retention easily justifies investments when considering potential million-dollar penalties.

Cost Monitoring

Use AWS Cost Explorer, Azure Cost Management for granular visibility. Implement automated alerts and optimization recommendations.

Tools and Technologies for Log Retention

The right tools can automate your retention policies, reduce costs, and ensure compliance across your entire infrastructure. Consider the following:

Enterprise Log Management Platforms

| Platform | Key Features | Cost Savings | Best For |

| Splunk Enterprise | Index Lifecycle Management (ILM), automated tier transitions, cloud storage integration | 70-90% cost reductions | Search capabilities across all retention periods |

| Elastic Stack | Sophisticated ILM, rollover criteria, automated index optimization | Petabyte-scale retention | Large-scale deployments with snapshot repositories |

| Datadog | Cloud-native retention (3 days-18 months), intelligent sampling, custom tags | Automated cost optimization | Cloud-first organizations |

| IBM QRadar | Security-focused retention, forensic analysis, compliance reporting | Compressed storage | Security operations and incident investigation |

| Microsoft Sentinel | Azure-integrated retention up to 12 years, Data Explorer integration | Data transformation optimization | Microsoft ecosystem environments |

Cloud-Native Solutions

| Platform | Retention Limits | Storage Integration | Best For |

| AWS CloudWatch Logs | 1 day to never expire | S3 archival, intelligent tiering | AWS-native environments |

| Azure Monitor | Up to 730 days | Azure Storage, immutable storage | Azure-centric deployments |

| Google Cloud Logging | Up to 3,650 days | BigQuery routing, Cloud Storage | Google Cloud Platform users |

| Cloud Storage Services | Unlimited | Lifecycle management, legal hold | Direct archival needs |

Open Source and Custom Solutions

| Solution | Flexibility | Best For | Key Benefits |

| ELK Stack + Curator | High | Custom retention rules | Full control over retention logic |

| Fluentd/Fluent Bit | Very High | Vendor independence | Flexible configuration, custom policies |

| Custom Scripts | Maximum | Unique requirements | Python/Bash/PowerShell integration |

| Database Solutions | Medium | Structured data | SQL-based policies, automated partitioning |

Common Challenges and Solutions

Even solid log retention policies run into problems when you try to implement them. Storage costs keep climbing, compliance gets messy, and these predictable issues can wreck your entire program.

| Challenge | Problem | Solution |

| Storage Cost Escalation | 50TB annually → 350TB over 7 years, $500K+ costs | Tiered storage: hot → warm → cold (90% savings, 60-75% reduction) |

| Compliance Complexity | GDPR vs SEC conflicts | Retention matrices + longest period + data anonymization |

| Access and Retrieval | Cold storage = hours for retrieval | Hybrid: critical logs in warm storage 12-18 months |

| Data Quality | Corruption, format evolution | Checksums + validation + standardized formats |

| Technology Evolution | New formats, platform updates | JSON/XML standards + automated conversion |

| Legal Holds | Litigation preservation needs | Automated hold platforms + audit trails |

| Cross-System Coordination | Inconsistent implementation | Centralized platforms (Splunk/Elastic) |

Monitoring and Compliance Auditing

Effective log retention requires continuous oversight to ensure policies are followed, costs remain controlled, and audit requirements are met.

Compliance Monitoring

Automated systems track key metrics: retention compliance rates (target: 99.5%), policy violations, storage utilization, and deletion adherence. Real-time dashboards highlight approaching deadlines and exceptions.

Audit Preparation

Maintain comprehensive documentation like policy approvals, implementation timestamps, retention actions, and exception approvals. Quarterly reports document metrics, cost achievements, and deviations with justifications.

Retention Reporting

Monthly status reports, quarterly assessments, annual reviews. Track data volumes, cost trends, compliance rates, and access fulfillment times. Executive dashboards highlight risks and opportunities for optimization.

Exception Tracking

Formal procedures for legal holds, business requirements, and technical constraints. Track approval workflows, implementation status, and resolution timelines with complete audit trails.

Legal Hold Management

Automatically pauses deletion policies during litigation. Includes notification systems, scope documentation, and controlled release procedures when holds are lifted.

Regular Reviews

Check for new regulations, business changes, and tech upgrades every year. See what’s working, find ways to cut costs, and learn from your mistakes.

Conclusion

Log retention used to be an IT afterthought. Now it’s a business priority. Companies with solid policies avoid fines, support security investigations, and control costs through automation and tiered storage.

The team needs balance: compliance requires long-term retention, security needs forensic data, operations wants easy access, and finance wants cost cuts. Mix automation, tiered storage, and regular updates.

Next Steps:

- Audit current practices and find gaps

- Engage stakeholders across teams

- Develop policies using this guide

- Implement automation for consistency

- Monitor and optimize regularly

Stay informed through industry groups and legal counsel. Log retention is ongoing work, not a one-time setup.

Log Retention FAQs

How long should I retain different types of logs?

Security logs: 1-7 years, financial: 5-7 years (depending on SOX section), healthcare: 6 years (HIPAA), diagnostic: 30-90 days. Start with regulatory minimums.

What happens if I don’t comply with log retention requirements?

Penalties range from thousands to millions of dollars, plus litigation disadvantages and failed audits. The SEC fined 16 firms $81 million in February 2024.

How much does log retention typically cost?

$0.10-$25 per GB annually. Mid-size companies: $3,000-$20,000 yearly; enterprises: $500,000+. Tiered storage cuts costs 60-75%.

Can I use cloud storage for compliance-required log retention?

Yes. AWS, Azure, and Google Cloud offer compliance-grade storage with immutable features and audit trails, often cheaper than on-premises.

What’s the difference between log retention and log backup?

Backups: disaster recovery (30-90 days). Retention: compliance and forensics (years) with long-term accessibility focus.

How do I handle conflicting retention requirements?

Use the longest required period among the regulations. Apply data anonymization for privacy. Map each log type to applicable rules.

What should I do when storage costs become prohibitive?

Use tiered storage since cold storage costs 90% less. Add compression and automated lifecycle policies. Review if all logs need full retention.